EMBRACING THE FUTURE: Our cashless solution across branches.

Our cashless solutions have been carefully designed to provide a seamless and secure experience for our valued customers. We understand that the world is rapidly moving towards digital transactions, and we believe that going cashless not only keeps us at the forefront of this evolution but also offers numerous benefits to our customers.

We at Vec are thrilled to announce a revolutionary change in how we conduct business—a change that embraces the way money will be transacted in the future. We have decided to remove cash transactions from all of our branches as part of our commitment to innovation and client convenience.

Convenience: With our cashless solutions, customers no longer need to carry cash, count change, or visit ATMs before visiting our branches. Payments can be made effortlessly using various electronic payment methods, including credit/debit cards, mobile wallets, and online transfers.

Enhanced Security: Cashless transactions offer a higher level of security compared to cash payments. The risk of theft, loss, or counterfeit money is completely eliminated, ensuring that our customers' hard-earned money remains safe and protected.

Time-saving: By eliminating cash transactions, we significantly reduce the time spent on handling and processing physical money, leading to faster service at our branches. Customers can complete their transactions swiftly, allowing them to focus on other important aspects of their lives

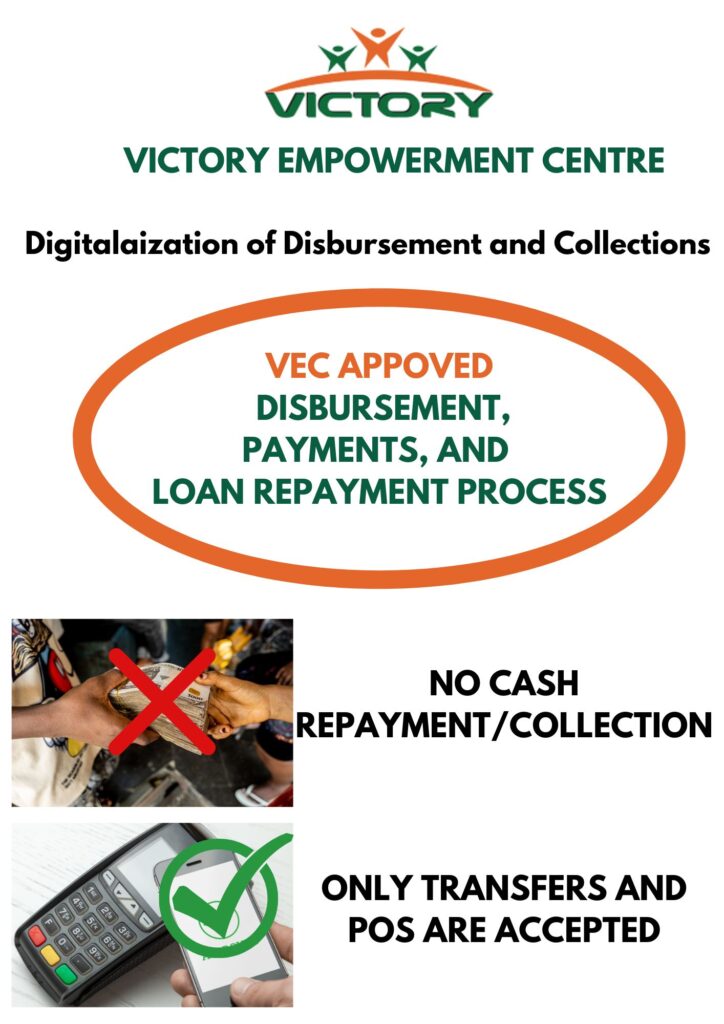

DIGITALAZATION OF DISBURSEMENT AND COLLECTIONS

Businesses all over the world are now recognizing the transformative power of technology to improve efficiency and streamline processes. VEC has adopted digitalization as a crucial tactic for transforming the collection and disbursement procedures. We have been able to optimize resource allocation, improve financial management, and improve customer experiences.

Streamling disbursement and collection processes VEC has transform collection process into a seamless and efficient operation through the use of USSD , Direct Debit, Bank transfers to VEC account, VEC POS or other POS to VEC account.

NOTE: In order to be eligible for a loan from VEC, all clients must have personal bank accounts. Numbers of VEC-approved bank accounts are clearly displayed in our branches. Each client has the sole responsibility to repay his/her loan to VEC account and not through any third party.

Since 2013,

Operating in 5 States

Victory Empowerment Centre is a micro-finance Non Governmental Organization (NGO) with a prime objective of improving the living of the poor women through innovative and flexible microfinance services.

- To promote a lasting positive change in the lives of the less privileged and the small-scale business operators in Nigeria.

- To create an opportunity for poor citizens to achieve their vision

- To enhance a better standard of Living in the Nigerian Communities

- To ensure sustainable development through fund empowerment, and skill acquisition

- To support structures that promote self-reliance and economy development

- To assist and guide people in obtaining financial assistance for future development

- Provision of employment to Nigerian youths.

Date of Establishment

2013

Date of Establishment

2013

Date of Establishment

2013

Our Mission

To support the active poor that are financially incapacitated by empowering them through Micro-credit scheme to improve their socio-economic condition.

Our Values For Excellence

To build a steady realizable future for the small scale business entrepreneurs for a better living in Nigeria, with special focus on women.

- Reliability

- Teamwork

- Excellent Customer Service

- Integrity

- Accountability

Membership

Membership is open only to active poor women, who are unable to have access to bank loans and are determined to engage in small financially viable activities through micro loans.

Microfinance being provision of financial services for poor and low-income clients without access to formal financial institutions offered by different types of service providers. In practice, the term is often used more narrowly to refer to loans and other services from providers that identify themselves as “micro-finance institutions” (MFIs). Microfinance refers to a movement that envisions a world in which low-income households have permanent access to a range of high quality and affordable financial services offered by a range of retail providers to finance income-producing activities, build assets, stabilize consumption, and protect against risks. These services include savings, credit, insurance, remittances, payments, and others.

The opportunity of Micro-financing was triggered by the poor performance of the conventional finance sector. The essence was to reach the overwhelming population of the poor in Nigeria and to assist in the drive to alleviate poverty. Barely a million had been provided with some small credit in Nigeria while over 40 million poor are yet to be attended to in terms of supply of microloans. Micro-finance specific institutions in Nigeria have not adequately addressed the gap in terms of credit, savings and other financial services required by the micro entrepreneurs. The existence of Micro-finance institutions in Nigeria was based on the existence of a huge unserved market, over 80 million people with a population of over 150 Million been the most populous country in Africa, two third of Nigeria people are poor and they all depend on microloan for their livelihood.

Victory Empowerment Centre is a microfinance Non Governmental Organization, registered with the Corporate Affairs Commission (CAC) Certificate Number (CAC/IT/NO 61969).

Also registered with Special Control Unit Against Money Laundering (SCUML) an arm of Economic And Financial Control Commission (EFCC) in Nigeria, Certificate Number SC 251400532. Having money lender’s permit with certificate no 210.

Victory Empowerment Centre methodology is based on international best practices in micro-finance delivery, and is essentially an adaptation of the Grooming People for Better Livelihood in Nigeria and International methodology to local market conditions.

The Initial Loan is N40,000 after repayment of the initial loan, the loan is increased in subsequent loan cycles. This is a continuous process until the client decides to end the services.